Ct 2024 Income Tax Calculator. Use our income tax calculator to find out what your take home pay will be in connecticut for the tax year. Paid family and medical leave (0.5%) the total taxes can account for approximately 20% to 35% of your paycheck.

The connecticut tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in connecticut, the calculator allows you to calculate. A comprehensive suite of free income tax calculators for connecticut, each tailored to a specific tax year.

Calculate Your Connecticut State Income Taxes.

For tax year 2024, the 3% rate for the lowest tax bracket will decrease to 2%.

Estimated Tax Payments For Tax Year 2024.

Curious about much you will pay in connecticut income tax?

Based On Your Projected Tax Withholding For The.

Images References :

Source: danitaadrianna.pages.dev

Source: danitaadrianna.pages.dev

Ct Tax Rates 2024 Dorie Geralda, Smartasset's connecticut paycheck calculator shows your hourly and salary income after federal, state and local taxes. Enter your info to see your take home pay.

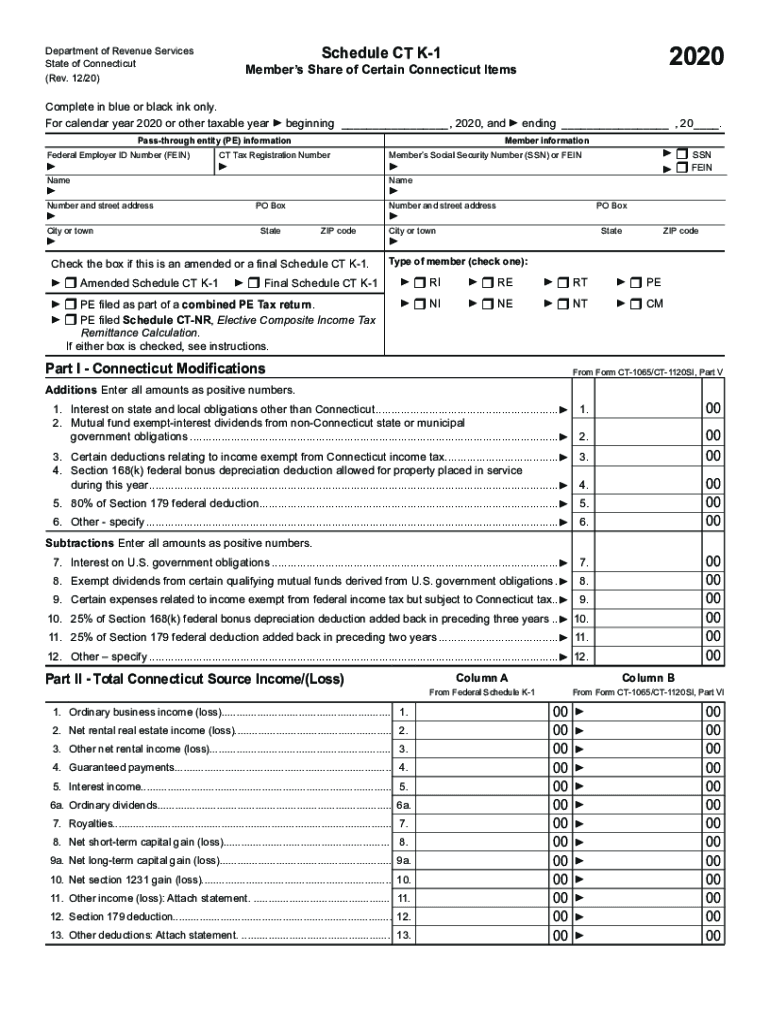

Source: www.signnow.com

Source: www.signnow.com

Ct K 1 20202024 Form Fill Out and Sign Printable PDF Template, Pension or annuity withholding calculator. The following calculators are available from myconnect.

Source: batubuayabradleys.blogspot.com

Source: batubuayabradleys.blogspot.com

Connecticut Tax Calculator, This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. The connecticut tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in connecticut, the calculator allows you to calculate.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, That means that your net pay will be $41,805 per year, or $3,484 per. The connecticut tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in connecticut, the calculator allows you to calculate.

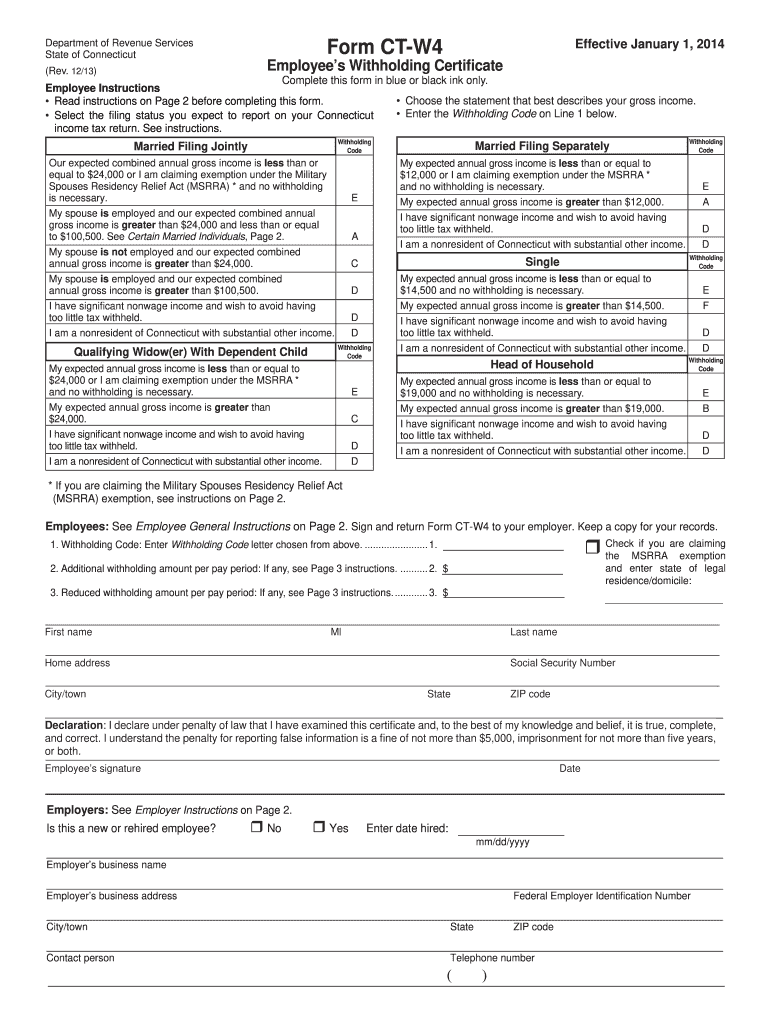

Source: www.dochub.com

Source: www.dochub.com

Ct w4 2023 Fill out & sign online DocHub, Use our income tax calculator to find out what your take home pay will be in connecticut for the tax year. Updated on apr 24 2024.

Source: blanchawelna.pages.dev

Source: blanchawelna.pages.dev

Tax Calculator 2024 2024 Alexa Harriot, Your connecticut income tax, after taking into account your connecticut. Enter your info to see your take home pay.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, Paid family and medical leave (0.5%) the total taxes can account for approximately 20% to 35% of your paycheck. A comprehensive suite of free income tax calculators for connecticut, each tailored to a specific tax year.

Source: 99employee.com

Source: 99employee.com

Tax Calculator to Calculate 2024 AY Tax Slab Amount, Estimated tax payments for tax year 2024. Meanwhile, the 5% rate applied to the next bracket will fall to 4.5%.

Source: www.taxformcalculator.com

Source: www.taxformcalculator.com

95180 95,180.00 Tax Calculator 2024/25 2024 Tax Refund Calculator, A comprehensive suite of free income tax calculators for connecticut, each tailored to a specific tax year. Your connecticut income tax, after taking into account your connecticut.

Source: www.asiriyar.net

Source: www.asiriyar.net

Tax Calculator Softwares 2024, If you make $55,000 a year living in the region of connecticut, usa, you will be taxed $13,195. Calculate your income tax in connecticut and salary deduction in connecticut to calculate and compare salary after tax for income in connecticut in the 2024 tax year.

Enter Your Details To Estimate Your Salary After Tax.

Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

You Must Make Estimated Income Tax Payments If:

Enter your filing status, income, deductions and credits and we will estimate your total taxes.